Search Results for "rmb sovereign bonds"

Hong Kong Monetary Authority Reports Results of RMB Sovereign Bond Tenders

The Hong Kong Monetary Authority announced the results of the RMB Sovereign Bond tenders held on October 15, 2025, marking a significant event in the financial markets.

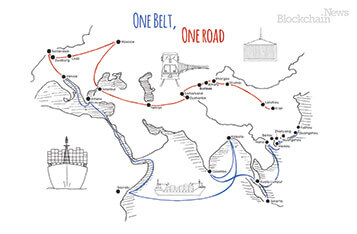

Belt and Road Initiative – Hong Kong the Gateway for RMB Internationalization

Many analysts have come to view BRI as a diplomatic offensive with geopolitical motives. However, the initiative is primarily driven by the Middle Kingdom’s pressing need to transform its national economy through further integration with the world.

ConsenSys Acquires US Brokerage Firm to Tokenize Outdated Municipal Bonds Market

ConsenSys has made a major acquisition of a U.S brokerage Firm to put traditional municipal bonds on the blockchain.

Could Bitcoin’s Next Price Boost Come from $8.5T in Sovereign Wealth Funds?

A prominent on-chain analyst believes Bitcoin's next boost is likely to come from sovereign wealth funds which hold around $8.5 trillion AUM, being managed by nations.

Global UAE Bank Building Blockchain Architecture for Federated and Sovereign Digital Identity

A global UAE bank is creating a federated and sovereign blockchain architecture for digital identity via HashCash Consultants, to propel its financial and banking operations and prepare for the future of finance.

Philippines Becomes the First to Leverage Blockchain to Issue Retail Treasury Bonds in Asia

The Filipino government has launched a blockchain-based app that will be utilized in the distribution of government-issued bonds. The novel project dubbed Bonds.PH was developed by the country’s Bureau of Treasury in conjunction with Union Bank and the Philippines Digital Asset Exchange.

China PBOC Views CBDC Race as "New Battlefied" Between Sovereign Nations

China through its apex bank, the People’s Bank of China (PBOC) has reiterated its desire to be the first nation to issue a Central Bank Digital Currency (CBDC)

Exclusive | FUSANG CEO: CCB’s $3 Billion in Blockchain-Based Debt Bonds is Rise of Crypto 2.0

According to FUSANG CEO Henry Chong, the CCB's historic blockchain-based bond listing, the first tranche of $3 billion in debt, marks a transition into what he calls “Crypto 2.0”

Arca Digital Asset Investment Firm Gets Approval from SEC to Tokenize US Treasury Bonds

Los Angeles-based digital asset investment firm Arca has launched trading for its new digitized security investment product that runs on the Ethereum blockchain.

Most People Will Hold Bitcoin Instead of Investing in Stocks, Bonds or Real Estate, says Market Analyst

Pierre Rochard, a market analyst and a Bitcoin advocate, believes that most people will be more inclined to hold BTC than assets like stocks.

Ethereum’s Vitalik Buterin: Centralized Digital Currencies Without Privacy Are a Huge Step Back

Vitalik Buterin the Ethereum co-founder believes that mainstream adoption of digital currencies is inevitable, with or without blockchain, but will that currency be sovereign, corporate or decentralized?

Malaysia's National Stock Exchange Conducts Blockchain PoC to Digitize Bond Market

Malaysia’s national stock exchange, Bursa Malaysia will conduct a blockchain Proof-of-Concept (PoC) dubbed "Project Harbour" to explore the DLT management of the country’s bonds market.